Mastering Board Management and Dynamics: A Guide for Effective Governance

Explore key strategies for building high-performing boards, understanding their dynamics, and driving effective governance to ensure long-term organizational success.

Jean-Louis Van Houwe

CEO & Founder

In today’s intricate business environment, the success and sustainability of any organization hinge on the performance of its board of directors. But what makes a board truly effective? Beyond assembling qualified individuals, it’s about managing intricate board dynamics and fostering collaboration. This guide explores the fundamentals of board management and dynamics, offering actionable insights to optimize governance.

Understanding Board Structures and Roles

The structure and role distribution within a board profoundly influence its effectiveness. There are two primary board models:

-

One-Tier Boards

In this model, executive and non-executive members collaborate within a single entity. This structure promotes seamless communication and collective decision-making. It is widely used in 23 jurisdictions, including the United States and the United Kingdom. However, it may present challenges, such as conflicts of interest between management and oversight responsibilities. -

Two-Tier Boards

This model separates governance into a supervisory board and an executive management board. The supervisory board provides independent oversight, ensuring objectivity in reviewing management’s decisions. Common in Germany and the Netherlands, this structure fosters accountability but requires clear boundaries to prevent operational inefficiencies.

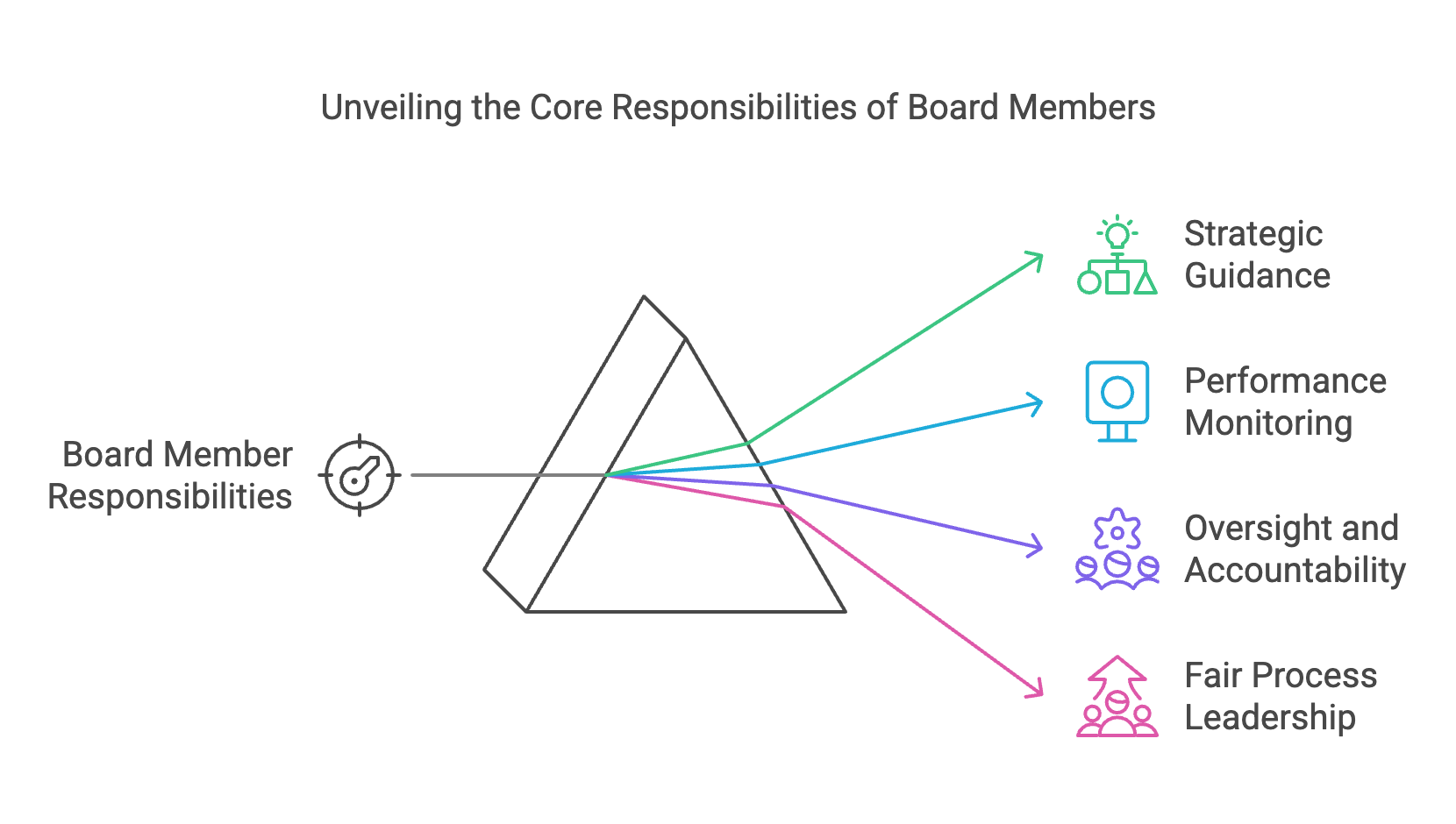

Key Roles and Responsibilities of Board Members

To operate effectively, board members must align on their roles, which include:

-

Strategic Guidance

Defining the organization’s vision and long-term objectives. For example, during an M&A process, boards must evaluate whether the deal aligns with the company’s strategic goals and enhances value. -

Performance Monitoring

Tracking financial performance, assessing risks, and ensuring key performance indicators (KPIs) are met. This includes monitoring the effectiveness of C-suite executives and integrating risk mitigation strategies. -

Oversight and Accountability

Ensuring management delivers on its commitments. This includes reviewing CEO performance, approving executive compensation, and assessing leadership pipelines for succession planning. -

Fair Process Leadership

Establishing a culture of transparency and equity in decision-making by promoting structured debates, collaborative discussions, and regular outcome evaluations. Learn more about fair leadership in our podcast series on fair process leadership.

The Importance of Board Dynamics

Board effectiveness transcends structure and roles. It depends significantly on team dynamics, which encompass:

-

Teamwork

Effective boards cultivate a collaborative environment. Each member contributes their expertise to decisions, while the chairperson mediates differences and maintains focus on organizational priorities. -

Decision-Making Styles

Boards with diverse perspectives encourage innovation and adaptability, whereas overly homogeneous boards risk groupthink. A structured, process-oriented approach to decision-making enhances objectivity and outcomes. -

Information Processing

Boards must digest vast amounts of data to make informed decisions. Regularly updated dashboards, financial reports, and strategic reviews enable effective deliberation and action. -

Engagement

High engagement translates to active participation and accountability. The board chair must ensure that all members remain focused, contributing to discussions and staying aligned with governance goals. -

Conflict Management

Boards must implement clear policies to address conflicts of interest, ensuring that decisions are made transparently and ethically.

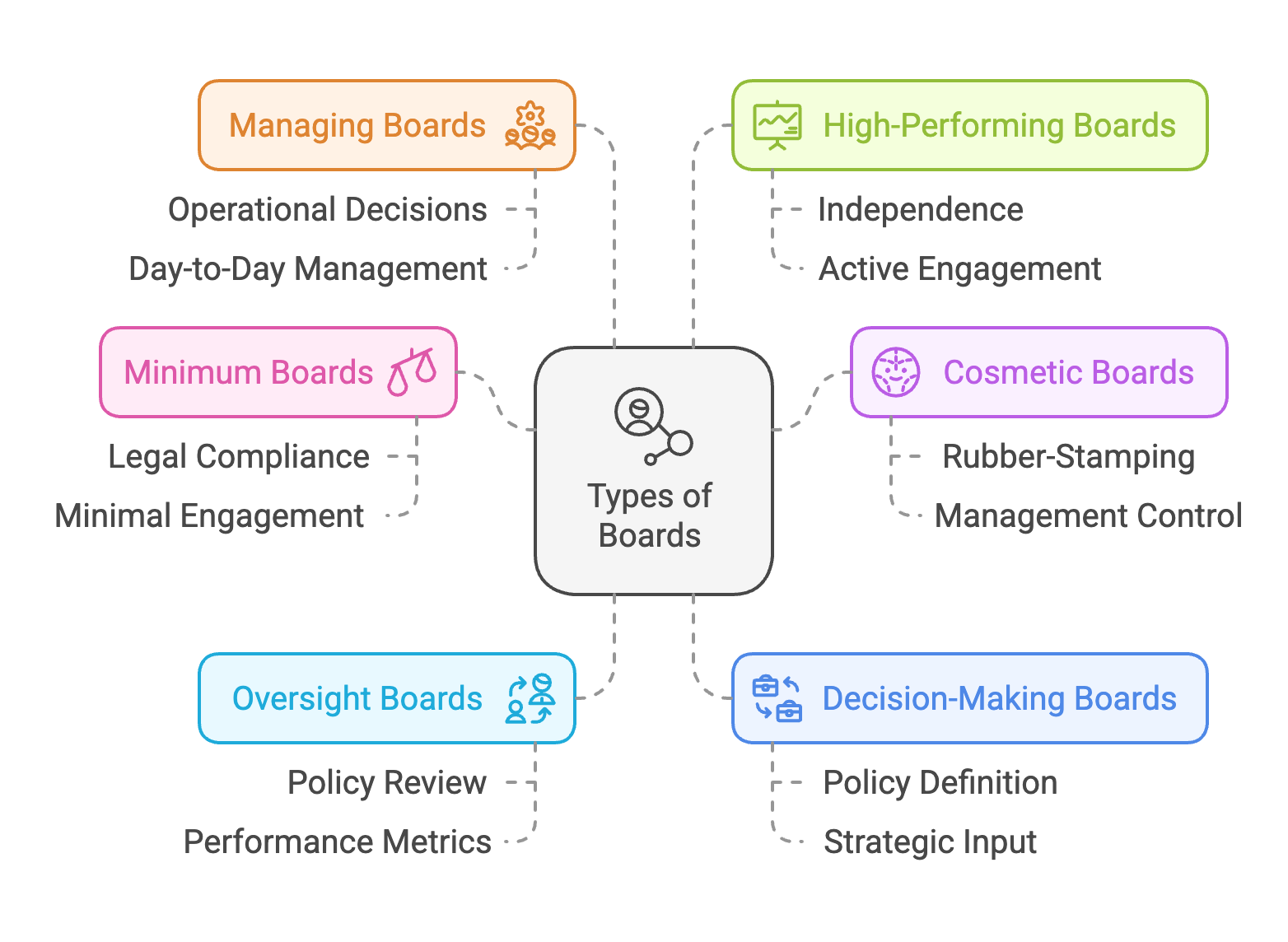

Types of Boards

Each board operates differently based on its purpose, structure, and level of engagement. Here’s a detailed breakdown:

-

Minimum Boards

These boards fulfill only the basic legal or statutory requirements, meeting occasionally to approve annual reports or other mandatory filings. While compliant, they contribute little to strategic decision-making or organizational growth. -

Cosmetic Boards

These serve as a superficial layer of governance, often rubber-stamping management decisions without robust scrutiny. Such boards are seen in organizations where management exerts significant control over the board, limiting its independence. -

Oversight Boards

Focused on reviewing policies, proposals, and performance metrics, these boards ensure compliance and adherence to strategic goals. While more engaged than cosmetic boards, they often lack the proactive involvement required for high performance. -

Decision-Making Boards

Actively involved in defining and authorizing policies, management objectives, and key strategies. These boards balance oversight with strategic input, making them effective for organizations that value governance as a partnership between management and the board. -

Managing Boards

These boards act almost as an extension of management, often involved in operational decisions and day-to-day management tasks. While this approach can be beneficial in smaller or early-stage organizations, it risks blurring the lines between governance and execution. -

High-Performing Boards

These boards are characterized by independence, accountability, and active engagement. Members clearly understand their roles and responsibilities, frequently interact with shareholders, and prioritize both short-term and long-term goals. They conduct regular evaluations and adapt quickly to changes in the business landscape.

Overcoming Challenges to Board Effectiveness

Even the most well-structured boards face hurdles. Common challenges include:

-

Information Gaps

Boards may struggle to access critical data in a timely and actionable manner. Independent audit committees can help bridge these gaps by validating financial information and linking it to strategic objectives. Learn more about overcoming information gaps in our podcast episode on board information challenges. -

Time Constraints

Board members often juggle multiple roles and responsibilities, requiring efficient time allocation and prioritization during meetings. -

Cognitive Biases

Personal biases and entrenched beliefs can distort decision-making. Regular training and the inclusion of diverse perspectives help mitigate these biases. -

Ethical Dilemmas

Boards may encounter ethical challenges, particularly during high-stakes situations like M&A. A clear code of conduct and adherence to corporate ethics are essential. -

CEO Succession Planning

Ensuring a smooth leadership transition requires a well-structured process that identifies potential successors, nurtures talent, and evaluates their readiness.

Enhancing Board Effectiveness

To cultivate a high-performing board, implement these best practices:

-

Clarify Roles and Responsibilities

Define clear expectations and accountabilities for each board member to avoid role overlap and inefficiencies. -

Promote Fair Process Leadership

Implement structured and transparent decision-making processes to foster collaboration and trust. -

Bridge Information Gaps

Provide members with comprehensive data and insights. This may include regular access to dashboards, third-party evaluations, and expert reports. -

Conduct Regular Evaluations

Assess the board’s overall performance, as well as individual contributions, to identify areas for improvement. -

Develop Succession Plans

Plan for leadership transitions by identifying, mentoring, and training high-potential candidates well in advance. -

Strengthen M&A Oversight

Boards should play an active role throughout the M&A lifecycle, from assessing strategic alignment to overseeing integration post-acquisition.

Effective boards regularly revisit and reinforce governance fundamentals. Our podcast episode on board first principles explores how starting with core governance concepts helps boards build strong foundations for decision-making and oversight.

Conclusion

Effective board management and dynamics are more than a governance requirement—they are a strategic advantage. By fostering collaboration, transparency, and accountability, boards can drive meaningful outcomes and ensure long-term value creation. Organizations that invest in building high-performing boards position themselves for sustained success in an ever-changing business landscape.